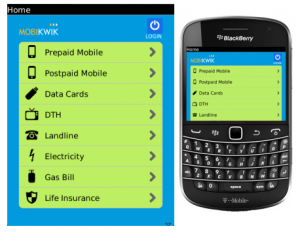

The growth of the smartphone industry has in turn led to the growth of many companies in this particular field and Mobikwik happens to be just one of those companies. MobiKwik is a closed wallet company which was initially started in 2009. The Mobikwik mobile app records around 100,000 transactions every day across the country. The Mobikwik company is growing by about six to eight times each year. However, this has mostly been dependent on the smartphone industry growth in the country. The growth of Mobikwik depends on the adoption of the smartphones by the consumers in the country. As the prices of most of the smartphones are coming down and as the adoption of smartphones are increasing so does the usage of the Mobikwik mobile app. Mobikwik has over two million customers on Android, about 4.5 million on iPhone and more than half a million on the Windows platform. Mobikwik differentiate themselves by providing innovative services like the cash pay service.

Somebody from the Mobikwik team will visit the customers, collect the cash and then they will deposit it in your mobile wallet. The Mobikwik company aims to have more than 15 million customers by the end of the present year. MobiKwik also has tie-ups with most of the telco operators for prepaid recharges. The average online mobile recharge for any transaction on MobiKwik is between Rs 100 and Rs 150. The Mobikwik company gets between Rs 3 and Rs 4 for every recharge. The Mobikwik company is now all set to launch an unique money transfer product, which it claims will be different than the current products that are available in the market. This product will be hugely different from what is available in the market today. What is currently available is something that is like assisted transfer but theirs will be different and will not need any assistance. Also, all the products like Vodafone’s mPesa or Airtel Money are only targeting a different set of people. Mobikwik would be targeting people who have internet because their cash usage is decreasing and the market is huge. The product is most likely to be launched in the upcoming months.

By significantly reducing the number of steps that is required to realize a payment, the success rate of a single online transaction increases significantly. This is because it does not involve any bank account or for that matter even cards. The Cash pay from Mobikwik app service helps in significantly reducing the Cash on Delivery transactions for other e-commerce companies.

Mobikwik wallet helps merchants to boost the shopping experience, significantly on the mobile. The MobiKwik wallet is also designed to deliver a consistent, quick and smooth checkout experience, which is irrespective of either merchant or channel; it generally delivers an almost 100% transaction success, mostly on the mobile because it requires just one simple click to complete the payment transaction.

Almost all Users are concerned over the security of their personal information, bank accounts and are scared of financial loss. Once the customers gain confidence in mobile security, then they will increase their mobile payment activity much more. The need for creating the trust in the consumer’s mind is extremely vital. And Mobikwik has nailed it.

Leave a Reply